As an investor, you should know the various orders for buying and selling securities. Basket orders and single stock orders are two general transaction categories. In this blog, we will compare basket orders vs single stock orders and describe the advantages and disadvantages of each.

What exactly is a Basket Order?

A basket order is a form of order that lets you purchase or trade numerous stocks simultaneously. You can make a single purchase for a basket of stocks instead of making individual orders for each company. Basket Orders can be helpful if you want to invest in a group of supplies linked to a particular business or area.

If you wanted to buy in the technology industry, you could make a basket order that included Apple, Microsoft, and Amazon securities. Basket orders allow you to invest in the entire sector without purchasing each stock individually.

What exactly is a Single Stock Order?

A single stock order is a form in which you can buy or trade a single company. You can designate the company you want to purchase or sell, the number of shares you wish to trade, and the amount you are ready to pay or receive with a single stock order. Individual buyers most commonly use this form of order.

Comparison of Basket Orders vs Single Stock Orders

Now that we’ve defined basket and single stock orders, let’s compare them and explore their advantages and disadvantages.

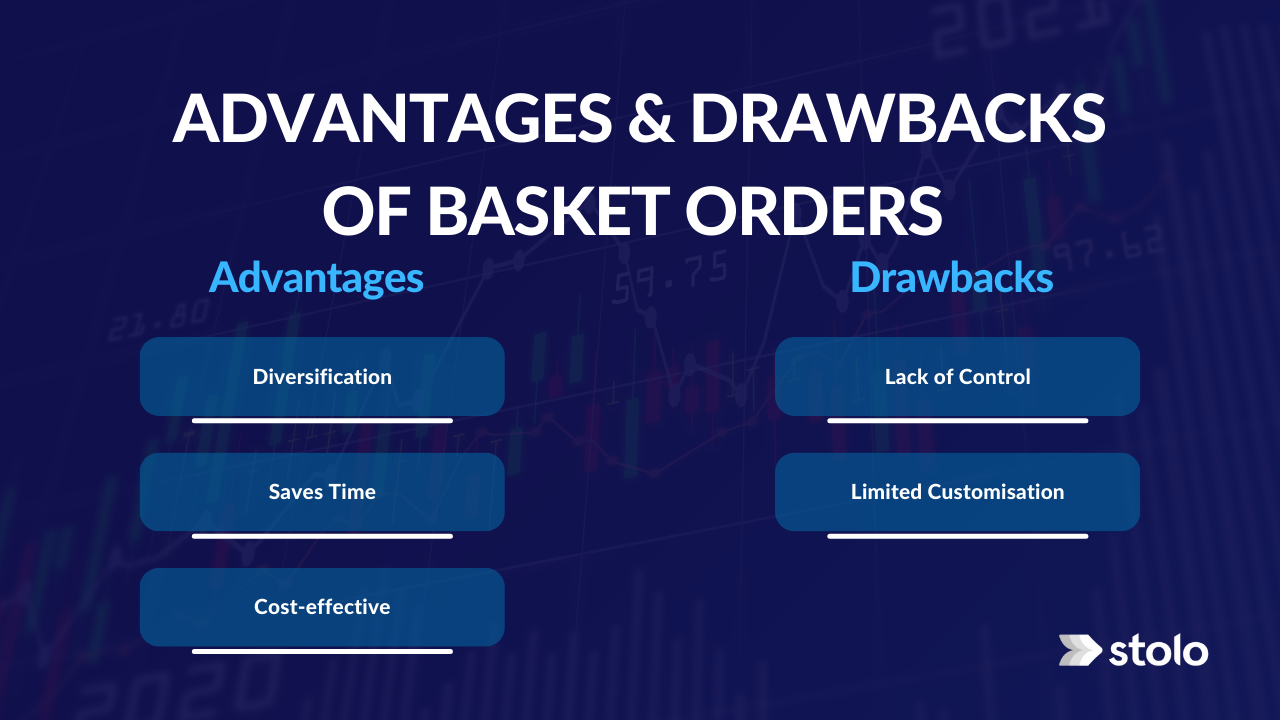

Advantages of Basket Orders

- Diversification:

You can distribute your investment across numerous businesses and lower your total risk by buying in a collection of securities. This is because if one business in the basket performs poorly, the other companies compensate.

- Saves Time:

You can make a single purchase for a basket of stocks rather than placing individual orders for each company. Basket Orders can save you time and effort, particularly if you have many companies to engage in.

- Cost-effective

When you make a basket purchase, you pay a single commission fee rather than distinct commission fees for each product. This can be less expensive, mainly if you engage in many securities.

Drawbacks of Basket Orders

- Lack of Control

Investing in a basket of securities gives you less influence over individual companies. If one of the stocks in the portfolio underperforms, you may not be able to sell it without impacting the other stocks in the basket.

- Limited Customisation

When you buy in a stock basket, your options are confined to the companies in the basket. This means you may need help to tailor your portfolio to your particular requirements and financial objectives.

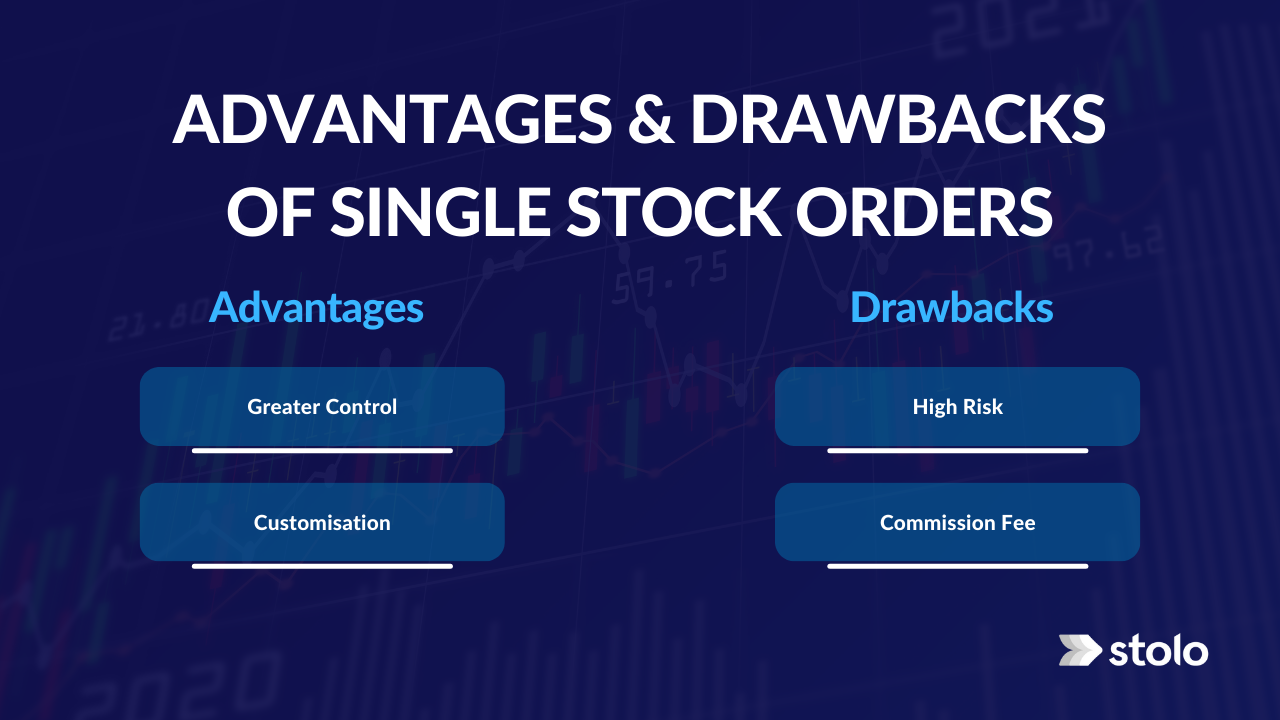

Advantages of Single Stock Orders

- Greater Control

You have more power over the specific companies in your portfolio when you use single-stock purchases. If a company performs poorly, you can sell it instantly without affecting the other companies in your portfolio.

- Customisation

Single stock orders allow you to tailor your portfolio to your requirements and financial objectives. This means you can select the stocks best suited to your financial plan.

Drawbacks of Single Stock Orders

- High Risk

Single-stock purchases subject you to more risk than basket orders. The risk occurs as single stock’s poor performance can substantially affect your entire portfolio.

- Commission Fee

A commission fee applies to each sale when you purchase a single stock. The cost can be more expensive than making a basket order, particularly if you want to engage in many securities.

Conclusion

As we compare basket orders vs single stock orders, both have advantages and disadvantages. Basket orders benefit buyers who want to diversify their investments while saving time.