In the constantly fluctuating world of options trading, understanding the nuances of implied volatility (IV) can significantly elevate an investor’s strategy. But how exactly does implied volatility impact option chain analysis? This blog post aims to demystify the concept of IV, offering both novices and seasoned traders insights into its pivotal role in trading decisions.

What Is Implied Volatility?

Before diving into the complex relationship between IV and option chain analysis, let’s first understand what implied volatility is. In essence, IV is a metric that reflects the market’s forecast of a likely movement in a security’s price. Unlike historical volatility, which looks at past trends, IV focuses on future volatility and is derived from the price of an option itself. It represents an expectation, not a certainty, and it plays a crucial role in the pricing of options.

The Impact of Implied Volatility on Option Pricing

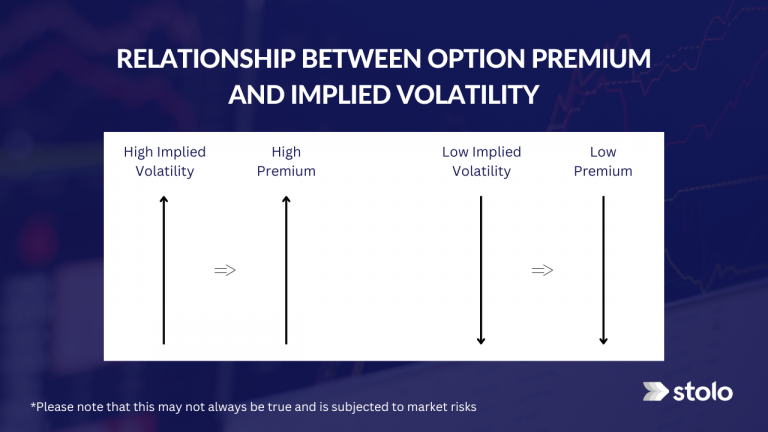

Implied volatility is directly proportional to the price of options. As IV increases, so does the option premium, and vice versa. This relationship is central to option trading, as it affects not only the cost of entering trades but also the potential profitability of different strategies.

Why Higher IV Elevates Option Premiums

The rationale behind higher IV leading to higher option premiums is relatively straightforward. When the market expects significant price movement, the likelihood of an option ending in the money increases. This heightened potential for profit (or loss, from the writer’s perspective) necessitates a higher premium to balance the scales. Here’s how this plays out:

- For Call Options: An increase in IV suggests a higher forecast of the underlying stock’s price climbing, making calls more expensive.

- For Put Options: Similarly, an uptick in IV indicates a greater chance of the stock price falling, thereby raising the cost of puts.

Related Blog: The Relationship Between Options Premium And Implied Volatility

Impact of Implied Volatility in Options Chain Analysis

The option chain is a comprehensive list displaying all available option contracts, both calls and puts, for a particular security. It’s an essential tool for traders, offering insights into various aspects such as strike prices, expiration dates, and, importantly, IV levels.

Interpreting IV in Option Chains

When analyzing an option chain, IV helps traders identify potential trading opportunities. High IV levels might indicate upcoming news, earnings reports, or other events that could lead to substantial price movement in the underlying asset. Conversely, lower IV suggests a period of stability or lack of significant expected price changes.

Related Blog: 5 Ways To Read And Interpret An Option Chain

Volatility Smiles and Skews: Reading Between the Lines

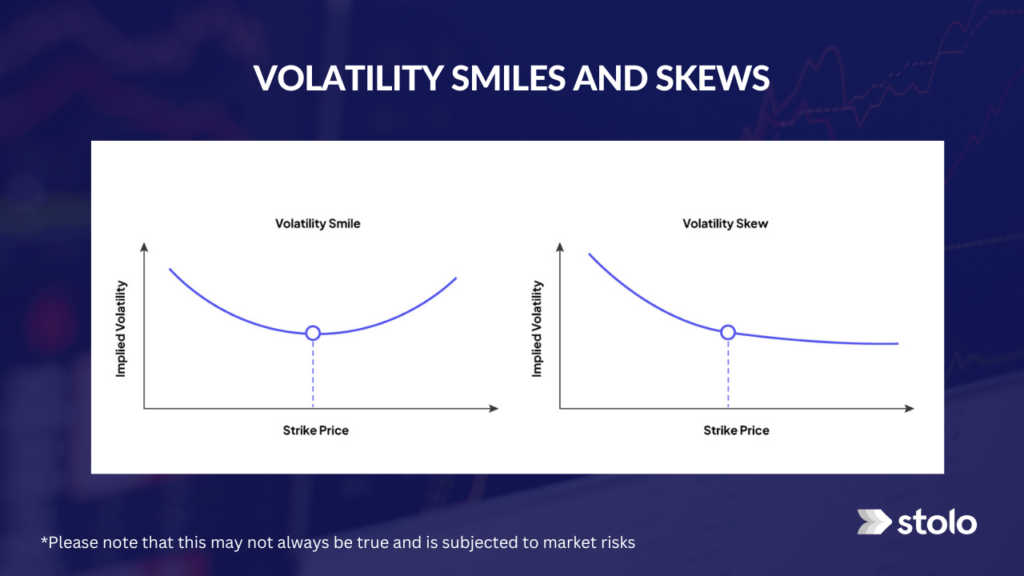

A closer examination of IV across different strike prices can reveal volatility smiles or skews. These patterns provide clues about market sentiment and potential directional movements of the underlying security.

- Volatility Smile: A situation where options with strike prices far from the current stock price (both ITM and OTM) have higher IVs, creating a smile-like curve on a graph. This could imply a balanced uncertainty in the market regarding upward or downward movements.

- Volatility Skew: Occurs when IV levels are higher for OTM puts than for OTM calls, indicating a market expectation of a potential downturn. It reflects the investors’ demand for downside protection.

Incorporating Implied Volatility into Your Strategy

Understanding IV is one thing; using it to refine your trading strategy is another. Here are a few ways traders might leverage IV in their decision-making process:

- Selling Premium in High IV Environments: When IV is high, option premiums are inflated. This can be an opportune time for traders to sell options, capitalizing on the eventual decline in IV (and therefore, option prices) to close positions at a lower cost.

- Buying Options in Low IV Settings: Conversely, when IV is low, buying options can be more favorable because the cost of entry is lower. If IV rises after purchasing, even without a significant move in the underlying asset’s price, the option’s value could increase.

- Strategic Selection of Expiration Dates: IV can influence the choice of expiration dates. Options with a longer time to expiration are more sensitive to changes in IV due to Vega, a measure of an option’s sensitivity to changes in IV. Understanding this relationship can help traders choose the appropriate expiration dates based on their IV expectations.

Navigating IV Crush

A significant risk associated with trading options in high IV scenarios is the IV crush. This phenomenon occurs when IV plummets post an anticipated event (like earnings reports), causing a sharp decline in option premiums. Traders can mitigate the impact of IV crush on option chain analysis by:

- Timing Trades: Consider the timing of entering and exiting trades around events that could cause IV fluctuations.

- Spreads: Using spread strategies can help manage the risks associated with high IV environments by offsetting the cost of buying options with the premium collected from selling options.

Conclusion

In options trading, implied volatility serves as both a guide and a warning signal. The impact of implied volitility on option chain analysis is profound, offering traders insights into market expectations, potential price movements, and the valuation of option contracts. By thoughtfully incorporating IV into their trading strategies, investors can navigate the tumultuous seas of the options market with more confidence and, potentially, greater success.

Remember, while IV is a powerful tool in the options trader’s arsenal, it’s but one piece of the puzzle. A holistic approach, considering other factors such as historical volatility, market sentiment, and fundamental analysis, will invariably lead to more informed decision-making. Happy trading!