Many new investors find the options trading world complicated and frequently intimidating. It can be difficult to comprehend how different variables. It can get confusing from implied volatility to the price of the fundamental commodity interacting with one another. However, one factor that plays an essential role in options trading is implied volatility. This article will discuss the relationship between options premiums and implied volatility.

Implied Volatility

Implied volatility helps measure the anticipated price fluctuation of the underlying commodity, as indicated by the option’s price. It is frequently called the “market’s expectation” of the underlying asset’s volatility. The implied volatility of an option is determined using certain factors. The option’s present market price, strike price, remaining time until expiration, and interest rates.

Premium Price

An option’s premium is the price an investor pays to buy the option. It is calculated using a mathematical model that considers several factors, including the underlying asset’s current price, the option’s strike price, the time to expiration, and implied volatility.

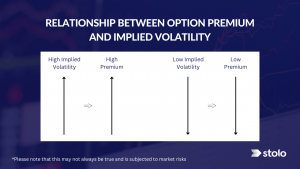

One of the critical relationships in options trading is the inverse relationship between options premiums and implied volatility. This means that as implied volatility increases, an option’s premium also increases, and as implied volatility decreases, the premium of an option also decreases.

Why does Implied Volatility Affect Options Premiums?

Implied volatility reflects the market’s expectation of the potential price movement of the underlying asset. Generally, when the market expects the underlying asset to have higher volatility, the option’s premium increases to reflect the higher expected price movement. The option’s premium decreases when the market expects the underlying asset to have lower volatility.

Let’s consider a hypothetical example to better understand this relationship. Suppose a trader is interested in buying a call option on a stock with a strike price of ₹50. Let’s consider the stock has an expiration date of three months. If the stock’s current price is ₹50, and the implied volatility is 20%, the call option premium might be ₹3.50 per share. However, if the implied volatility increases to 30%, the premium of the same call option might increase to ₹5 per share.

Conversely, if the implied volatility decreases to 10%, the premium of the same call option might decrease to ₹2 per share.

The relationship between options premium and implied volatility can be challenging to understand, as it is not always intuitive. However, it is an essential concept for options traders to grasp, as it can significantly impact their profitability.

How to Use Implied Volatility to Trade Options?

As we’ve seen, implied volatility is a key factor in setting an option’s price. As a result, implied volatility is important for options traders when making informed choices.

One strategy that options traders often use is to buy options when implied volatility is low and sell options when implied volatility is high. When implied volatility is low, options premiums are often relatively low, and buying options can be less expensive.

Conversely, when implied volatility is high, options premiums are often relatively high, making it more attractive to sell options.

Options traders use implied volatility expectations to trade. They buy call options if they expect implied volatility to rise, increasing the option price. They buy put options if they expect implied volatility to fall, decreasing the option premium.

How Can Relationship Between Options Premium and Implied Volatility Help in Trading?

Understanding the fundamentals of the stock market and their relations with each other can help traders make constructive strategies. In the stock market, strategy is everything. Strategy is a roadmap that guides traders and also aids them in making informed decisions. With market dynamics and market uncertainties, a trader must always have a strategy in place. Having a strategy is critical to making a profit, reducing loss and even staying ahead of the game.

Conclusion

In conclusion, learning the relationship between Implied Volatility and Options Premium can help you make better decisions. If you are an aspiring trader, explore the other relations with fundamental factors of trading. Knowing your basics right, can take you a long way and make you huge profits. Sign up with Stolo with explore Options premium in options trading.