As a trader, you’re probably always searching for methods to increase your earnings while decreasing your risks. The basket order is one instrument that can help you accomplish this objective. In this blog, we will examine what basket orders are, how they function, and why they can be valuable trading instruments.

What are Basket Orders?

A basket order is a form of trade that includes the simultaneous purchase or sale of numerous securities. Rather than executing each transaction separately, you can group them in a single order, a basket. This can save you time and effort, particularly if you trade many assets.

A trader uses basket orders for several different things. A basket order, for example, could be used to buy a stock portfolio or to sell a collection of equities as part of a rebalancing plan. A basket order can also perform a complicated options trading strategy, such as a butterfly spread or a straddle.

How Does Basket Order Work?

To make a basket order, you must provide the specifics of each trade you wish to perform. The security symbol, the number of shares or contracts to exchange, and the transaction form is usually included. (e.g. buy or sell, limit or market).

You can send your basket order to your broker once you’ve input all of the transactions you want to perform. Your broker will then perform each trade separately based on your directions.

Traders can perform basket orders immediately or later. Your broker will execute each transaction as quickly as feasible and at the best price. You can send a basket order as a market order if you want it to be executed instantly.

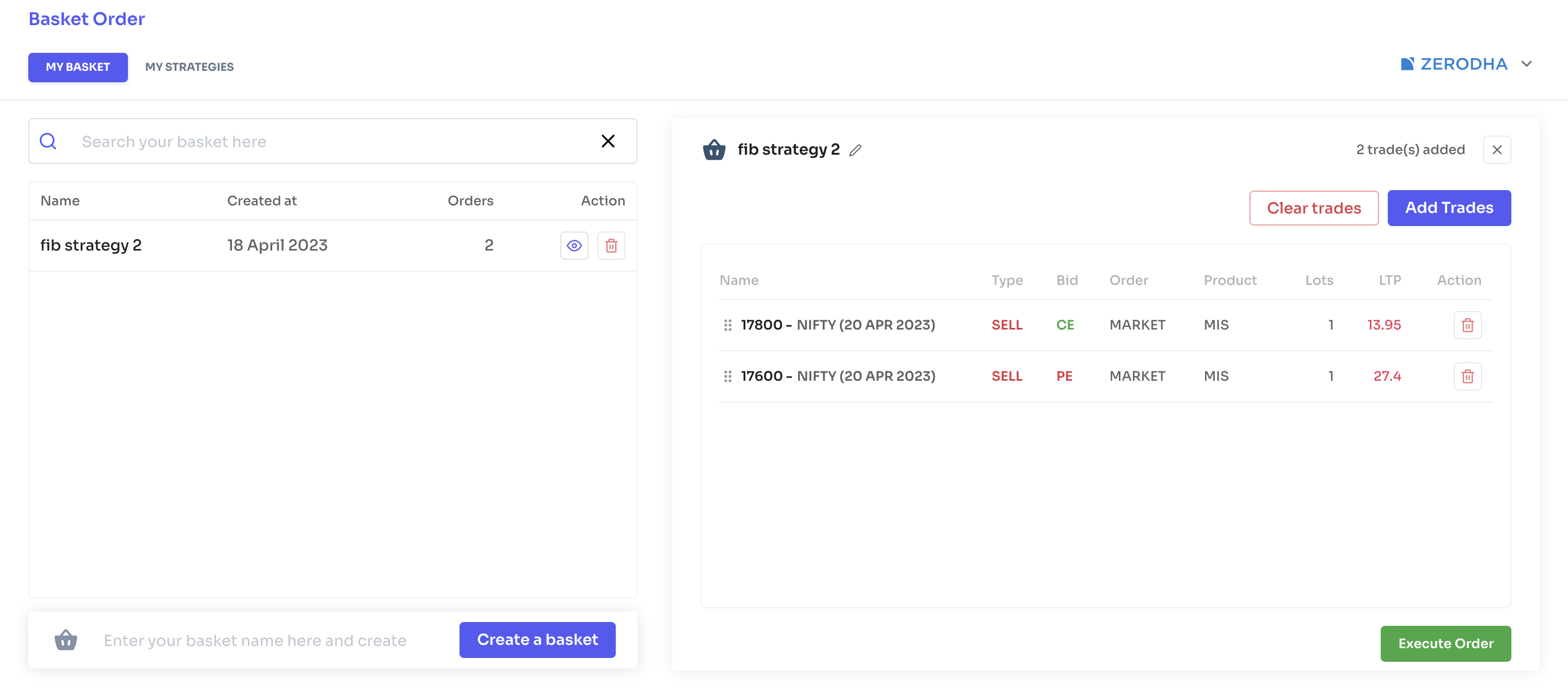

You can also send your basket purchase as a limit order. This implies that a trader specifies a price at which each transaction gets executed. Your broker will execute each transaction only if the market hits the amount you specify. Check out the basket order feature by the Stolo options trading platform below.

Why Should You Use Basket Orders?

Basket orders can be a useful instrument for dealers for various reasons.

First, basket orders can save you time and effort. Instead of entering each transaction separately, you can position them together in a single order. This is particularly helpful if you trade many assets or carry out complicated strategies.

Second, package purchases can assist you in risk management. You can ensure that your portfolio is well-balanced.

Third, basket orders can assist you in improving your buying success. Combining transactions can achieve diversity and exposure to various industries or asset classes.

Fourth, basket orders can carry out a wide range of buying tactics. A basket order, for example, could be used to implement a pairs trading plan in which you purchase one security and short-sell another. Alternatively, you could use a basket order to implement an options trading technique like a straddle or a butterfly spread.

Finally, basket orders can be an effective way to rebalance your investments. If you have a collection of stocks or other assets, you can use a basket order to rebalance your portfolio by selling some of your possessions and purchasing new ones. This can assist you in achieving your intended degree of risk and return and is particularly helpful in volatile markets.

Conclusion

Basket orders are useful for traders who want to maximise earnings while minimising risks. You can save time and effort by combining deals in a single order. In addition, also control risk, optimise your trading performance, implement various trading strategies, and adjust your account.