Investing in the stock market may be intimidating, mainly if you are new to it. However, employing sectoral indices might help to simplify the procedure. The Nifty Sectoral indexes are one of India’s most popular sectoral indexes.

What are Nifty Sectoral Indices?

The Nifty Sectoral indicators are a collection of indicators that follow several sectors of the Indian stock market. Each index is made up of a chosen set of firms that operate in a specific industry. The Nifty Auto Index, for example, measures the performance of firms involved in the vehicle sector. On the other hand, the Nifty Bank Index measures the performance of banks and financial organisations.

The National Stock Exchange of India (NSE) launched the Nifty Sectoral Indices in 1996. They have now evolved into a significant instrument for investors seeking exposure to specific sectors of the Indian economy.

Benefits of Investing in the Nifty Sectoral Indices?

One of the most significant benefits of investing in Nifty Sectoral Indices is that you may acquire exposure to a particular industry without buying individual stocks. This might be a low-cost approach to diversify your portfolio and lower your risk.

Furthermore, the performance of sectoral indexes is frequently a valuable measure of the sector’s overall health. For example, suppose the Nifty Pharma Index is performing well. In that case, it might indicate that the pharmaceutical industry is thriving, giving significant insights for individuals wishing to invest in a particular industry.

Another advantage of these indices is their ease of tracking. The NSE gives frequent information on each index’s performance, which can assist investors in making educated selections.

Sectoral Indices of the Nifty 50

Currently, 14 Nifty Sectoral Indices monitor different sectors of the Indian economy. These are some examples:

- Nifty Auto Index: Tracks the performance of firms in the car industry, including manufacturers and suppliers.

- Nifty Bank Index: The Nifty Bank Index measures the performance of Indian banks and financial organisations.

- Nifty Energy Index: Tracks the performance of energy firms, including oil and gas corporations.

- Nifty FMCG Index: The Nifty FMCG Index measures the performance of firms in the fast-moving consumer goods industry, which includes food and beverage companies.

- Nifty IT Index: The Nifty IT Index measures the performance of firms in the information technology industry, including software and IT service providers.

- Nifty Media Index: Tracks the performance of firms in the media and entertainment industries, such as broadcasting and publishing.

- Nifty Metal Index: Tracks the performance of firms in the metal and mining industries, including steel and aluminium.

- Nifty Pharma Index: The Nifty Pharma Index measures the performance of pharmaceutical firms.

- Nifty Private Bank Index: Tracks the performance of India’s private sector banks.

- Nifty PSU Bank Index: Tracks the performance of India’s public sector banks.

- Nifty Realty Index: The Nifty Realty Index measures the performance of firms in the real estate sector.

- Nifty Services Sector Index: Monitors the performance of firms in the services industry, such as hotels and tourism.

- Nifty Smallcap 100 Index: Tracks the performance of India’s smallcap enterprises.

- Nifty Midcap 100 Index: Tracks the performance of India’s mid-cap enterprises.

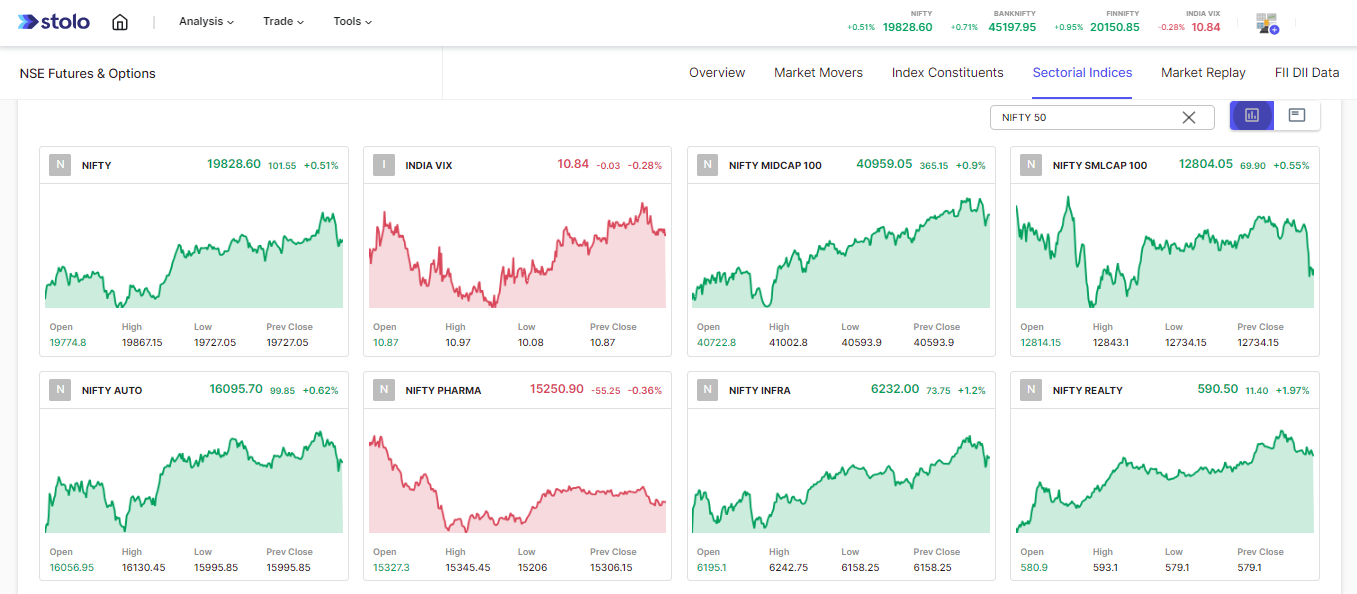

Sectoral Indices on Stolo

Find Stolo Sectoral Indices Charts under Market Analysis and Charts.

Sectoral Indices Charts on Stolo Options Trading Platform

Purchasing Nifty Sectoral Indices

Investing in the Nifty Sectoral Indices is a simple process. You may accomplish this by investing in exchange-traded funds (ETFs) or index funds that track certain sectoral indexes. These funds are meant to replicate the performance of the underlying index, allowing investors to acquire exposure to a specific industry without having to purchase individual companies.

Conclusion

Finally, Nifty Sectoral Indices provide investors with an easy and cost-effective alternative to obtain exposure to various sectors of the Indian economy. These indexes measure the performance of selected firms in each sector and give vital insights into the industry’s overall health. Investing in Nifty Sectoral Indices through ETFs, index funds, or mutual funds can help diversify your portfolio and decrease risk. Investors have a wide choice of alternatives based on their investment goals and risk tolerance, with 14 distinct sector indexes. Explore more of Nifty 50 sectoral indices on Stolo Options Trading Platform.