Options trading is a common investing approach traders employ to make revenue while managing risk. It entails purchasing and selling options contracts, which provide the holder with the right, but not the responsibility, to buy or sell an underlying asset at a particular price and period. The options premium is a major aspect of options trading that plays a significant role in determining the profitability of options contracts.

Options Premium

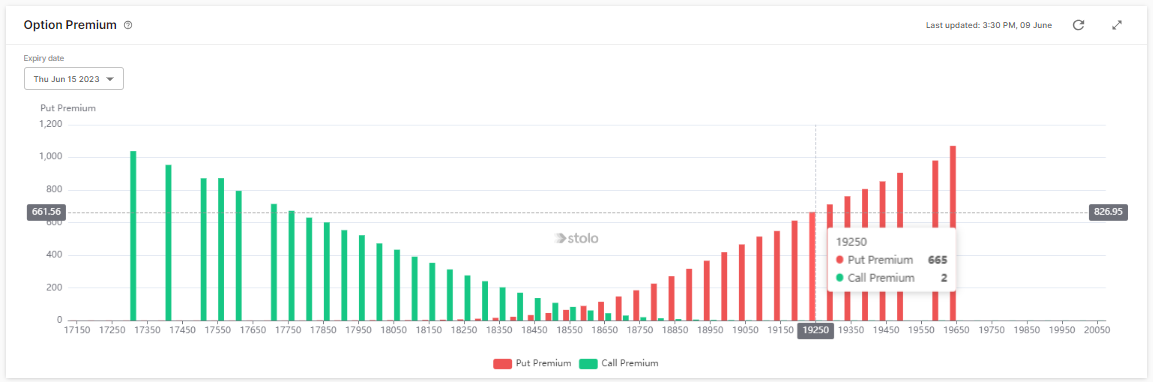

The sum paid by the buyer of an option to the seller, also known as the author of the option, is referred to as the options premium. It is the amount the buyer pays for the right to purchase or sell the underlying asset at a predetermined price, known as the strike price. The premium is determined by several factors, including the underlying asset’s current price, the time remaining before the option’s expiration date, and the amount of market volatility.

How Does Options Premium Work?

The options premium plays an important role in options trading. Options premium is the cost of acquiring an options contract. It is determined by the contract’s market supply and demand. When there is a great demand for the options contract, the premium rises; when there is a low demand, the premium falls.

Assume a trader wishes to purchase an options contract on XYZ stock, now trading at ₹100. The options contract allows the trader to purchase the stock for ₹105 next month. If the contract’s premium is ₹5, the trader must spend ₹500 (100 shares x ₹5 premium) to acquire the contract.

The options premium is the expected likelihood that the underlying asset will reach the strike price before the option expires. The higher the perceived likelihood, the larger the premium. If the underlying asset’s price advances in the direction of the option buyer’s position, the premium will rise as well, giving the buyer profit potential.

Role of Options Premium in Options Trading:

The options premium is important in options trading since it directly influences an option deal’s possible profit and loss. Before entering a transaction, traders can utilise the premium to evaluate their possible earnings and losses. It can also assist traders in risk management by lowering possible losses if the deal does not go as planned.

The premium might also give useful information regarding the market’s expectations for the underlying asset’s price movement. Traders can use the premium to assess market sentiment and evaluate if options are overpriced or underpriced. This data can assist traders in making educated judgements about whether to purchase or sell options contracts.

Furthermore, option-selling tactics can leverage the options premium to create revenue. Traders can sell options contracts and earn the premium as revenue if the underlying asset does not reach the strike price before the option expires. Selling covered calls is a common options trading method investors use to create additional revenue from their stock ownership.

Conclusion

Trading options may be a profitable investing strategy. You need a thorough grasp of the many components of options contracts, including the role of options premium in options trading. The premium is essential in determining a trade’s possible profit and loss. It may be utilised to minimise risk and produce money. To obtain the greatest possible outcome, traders must thoroughly analyse the premium and market circumstances before launching an options transaction. With the correct information and approach, options trading can be a vital instrument for investors wanting to produce profits in the financial markets.