If you’re interested in the stock market, you’ve probably heard of Foreign Institutional Investor (FII) and Domestic Institutional Investor (DII) data. But what is it, and how is it used in trading? This blog post will explore the basics of FII/DII data and its importance in trading.

What do FII and DII mean?

FIIs are foreign investors who invest in the Indian stock market. DIIs, on the other hand, are Indian investors who invest in the stock market. They are regarded as institutional investors since they make substantial stock market investments. Banks, insurance firms, mutual funds, and other financial institutions are examples of these investors.

What is FII/DII data?

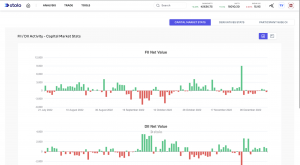

FII/DII data refers to the amount of money that FIIs and DIIs invest in the stock market. The Securities and Exchange Board of India (SEBI) makes the information available once a month. The information reveals the amount of money that FIIs and DIIs invested in or withdrew. The type of securities they invested in, such as stocks, bonds, or derivatives, is considered in further data segmentation.

Why is FII/DII data important in trading?

It primarily offers a perception of the actions of institutional investors. It offers information on institutional investors’ activity in the first place. Institutional investors are considered more skilled and experienced than individual investors, and their stock market investments may have a big influence.

Investing huge amounts of money in the stock market by FIIs and DIIs can be interpreted as a sign of confidence in the market. If investors decide to sell their investments, it may indicate a lack of confidence and even a bad market mood.

By examining data over time, trading professionals can spot trends and foresee future market moves. For example, traders believe the market will do well if FII investment has steadily increased over the past few months. Conversely, if DII investment declines, it could signal a bearish market.

Traders utilise FII/DII data to make investment decisions and analyse them. When FIIs and DIIs invest a significant amount of money in a certain stock or industry, it is seen as a sign of confidence in the future success of that company. This info, in turn, can encourage other investors to buy those equities.

Limitations of FII/DII Data

It’s important to note that FII/DII data is not a foolproof indicator of market performance. Institutional investors can make mistakes like individual investors, and factors outside the stock market can influence their investment decisions. For example, a sudden change in government policy could cause FIIs to withdraw their investments, even if they believe that the stock market will perform well in the future.

Despite these limitations, FII/DII data is useful for investors and traders. It helps traders to analyse market patterns, make investment decisions and offers insight into the behaviour of institutional investors. To help you make wiser financial decisions, you should combine it with other information and research.

Conclusion

To summarise, FII/DII data is an important part of the Indian stock market. It provides analytical information on institutional investors’ behaviour that can be used to identify market trends and choose investments. However, FII/DII data should be used in conjunction with additional investigation and market analysis. Access the FII/DII market by subscribing to Stolo options trading platform.