What Is Iron Butterfly Options Strategy?

The iron butterfly strategy is a typical options trading method for profiting from a stock or index. The technique entails selling both a call option and a put option at the same strike price while simultaneously purchasing a call option and a set option at a higher and lower strike price. If the underlying asset remains within a particular range at expiration, this results in a profit. This blog article will review the fundamentals of the iron butterfly options strategy, including its benefits and drawbacks, implementation, and risk management.

Advantages & Disadvantages of the Iron Butterfly Options Strategy

For traders, the iron butterfly options strategy offers various advantages. One of the most significant benefits is that it lets traders profit from a stock or index projected to stay inside a specific range. This can be effective in low-volatility markets or when a trader anticipates a stock or index to move within a given range.

Another advantage of the iron butterfly options strategy is its low risk and high payout. This implies that the maximum profit and loss are both known ahead of time, which can assist traders in risk management and avoiding surprise losses.

While the iron butterfly strategy has some advantages, traders should know the potential downsides. One of the critical downsides is that profiting from the technique might be difficult if the underlying asset swings dramatically in one way. The maximum return is restricted, but the potential loss is large if the underlying asset exceeds the strategy’s range.

The iron butterfly option strategy also has the disadvantage of requiring precise timing and high accuracy. Traders must be able to precisely estimate the underlying asset’s range at expiry as well as the timing of the deal.

Implementing Iron Butterfly Options Strategy

Achieve the iron butterfly options strategy by following the steps below:

Step 1: Determine the underlying asset and its expiration date.

Step 2: Establish a strike price for the call and put options. The strike prices for the call and put options should be the same, while the strike prices for the higher and lower options should be equidistant from the call and put options’ strike prices.

Step 3: At the strike price, sell the call and put options. This results in a short straddle posture.

Step 4: Purchase a call option with a higher strike price and a put option with a lower strike price. This results in a long strangle position.

Step 5: Wait for the expiration date. The trader will profit if the underlying asset remains inside the range provided by the iron butterfly technique. The trader will lose money if the underlying asset goes outside the range.

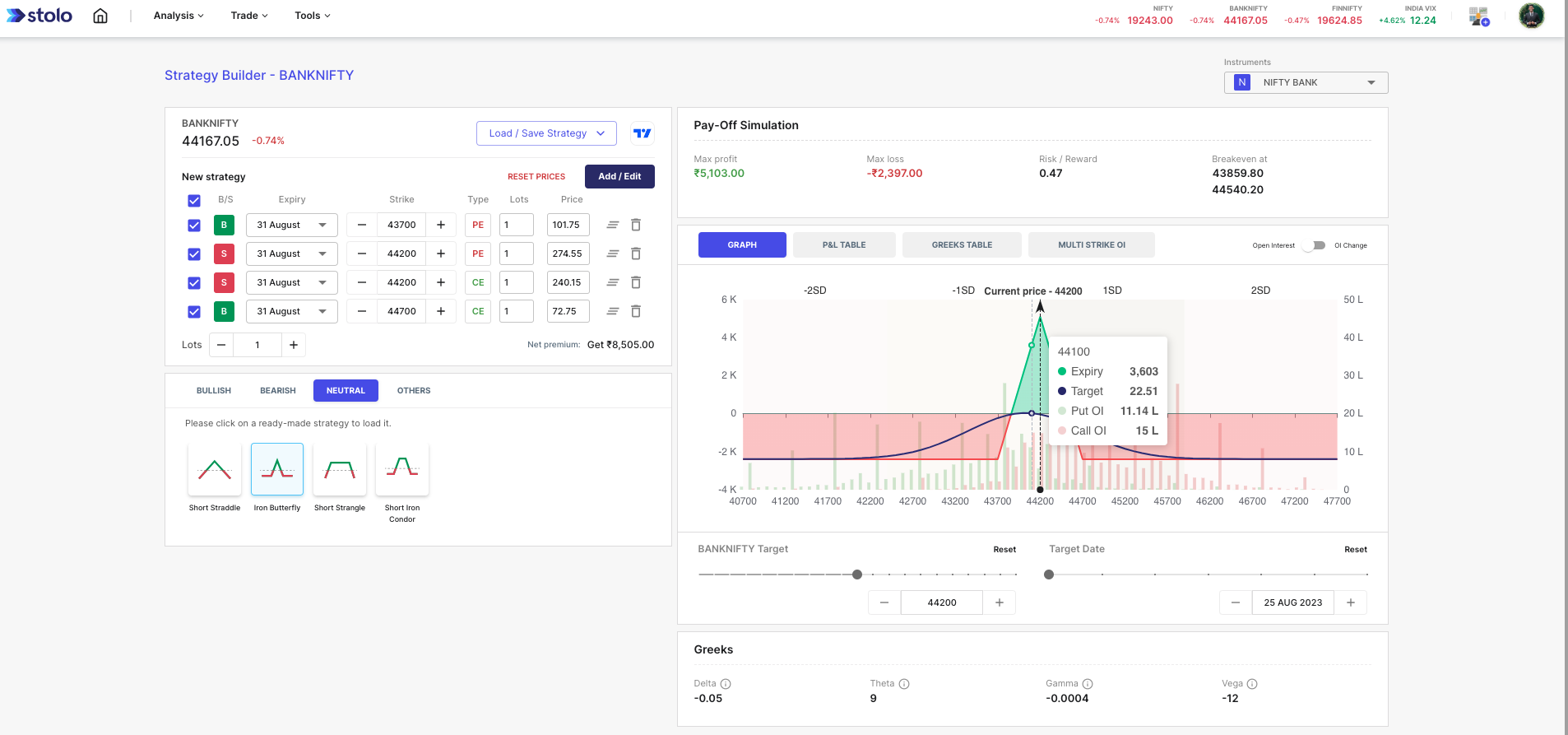

Take a look at how you can build Iron Butterfly Strategy on Stolo Options Strategy Builder

Risk Management

Traders can employ a variety of ways to manage risk in the iron butterfly strategy. One of the most critical is keeping the amount of cash invested in the plan to a minimum. Position size approaches can be used to accomplish this, such as dedicating a predetermined percentage of money to the strategy.

Stop-loss orders are another way to manage risk in the iron butterfly options strategy. Setting a specified degree of loss at which the position will be closed is what this entails. This can assist traders in limiting losses if the underlying asset goes outside of the strategy’s range.

Conclusion

The iron butterfly options trading strategy is a common method for profiting from a stock or index. The technique entails selling both a call option and a put option at the same strike price while simultaneously purchasing a call option and a put option at a higher and lower strike price. While the technique has various advantages, including minimal risk and the possibility to profit from low-volatility markets,